Important Things to Look for in a Depository Institution

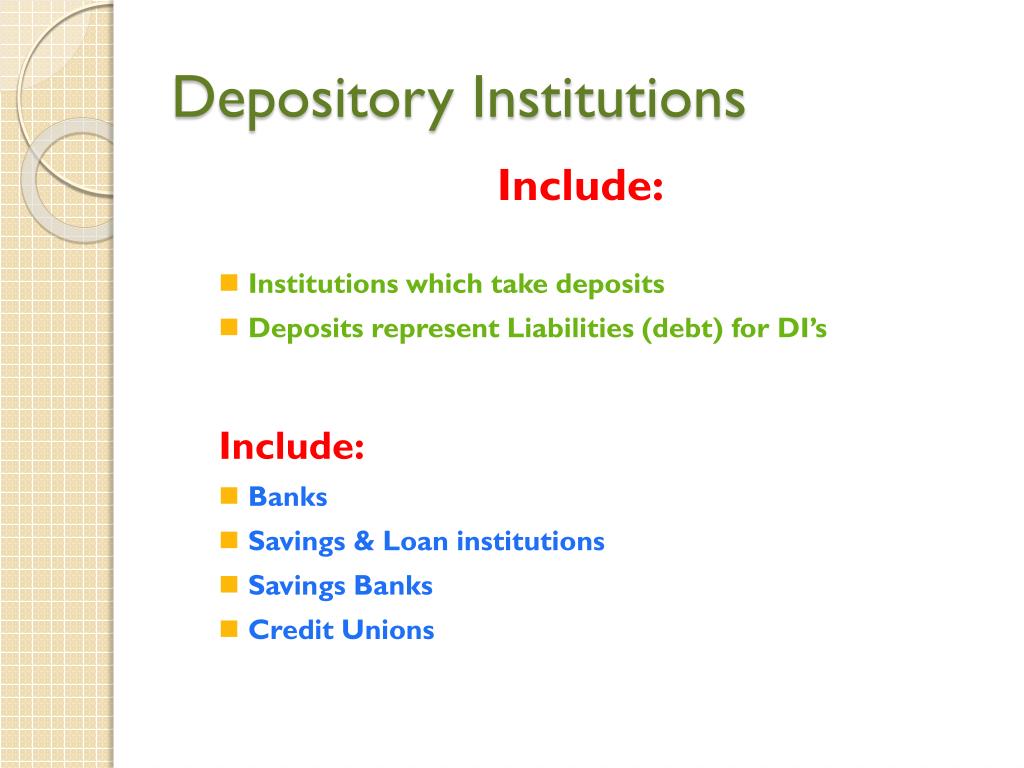

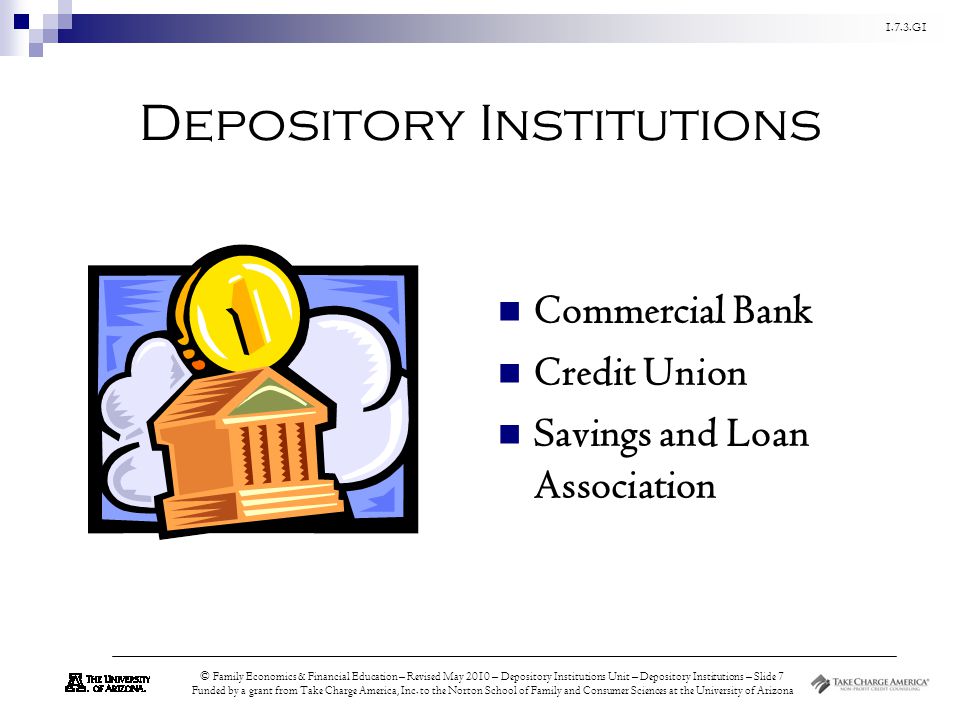

Depository institutions come in several different types. In the US depository institutions include.

Ch1 2 Overview Of The Financial System Financial Institutions And Markets Online Presentation

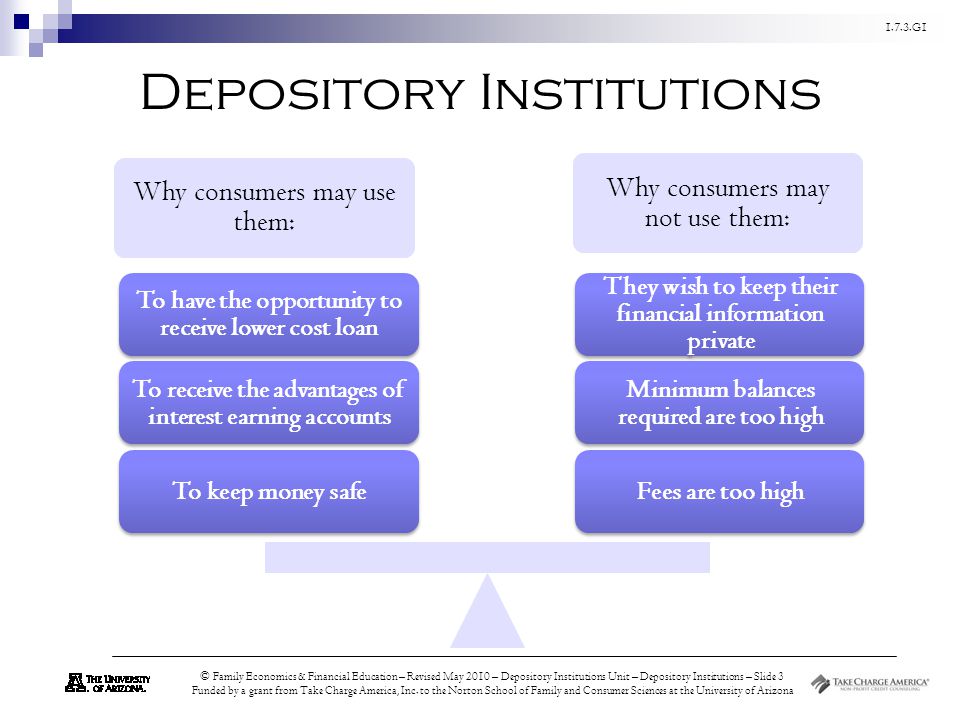

Find a depository institution that offers at least one type of checking account and one type of savings account.

. Make sure that any bank or credit union is. What are four factors you should consider when selecting a financial institution. These three things namely.

Research Find a depository institution that offers at least one type of checking account and one type of savings account. Some larger and global banks may also offer services for other banks and large organizations. What would be the three most important things you would look for in a depository institution.

Decide whether or not you should become a customer of this depository institution by conducting research and answering the questions in the table below. Security of your funds. The top ten things you should consider when choosing a banking institution are.

But things like stocks bonds mutual funds annuities and insurance products are not covered. What are the three most important things you would look for in a depository institution. If youve got a checking account savings account money market account or certificate of deposit youre covered.

At the same institution One of the most important factors to consider when choosing a. What would be the three most important factors that you would consider when deciding which depository institution fits your needs. Before Research What would be the three most important things you would look for in a depository institution.

Not every bank or credit union falls under federal protection so when youre shopping around be sure to look for the FDIC-Insured sign. The top ten things you should consider when. A plastic card that is electronically connected to the cardholders depository institution.

15 points for completion. ATM Automated Teller Machine. Up to 24 cash back 2.

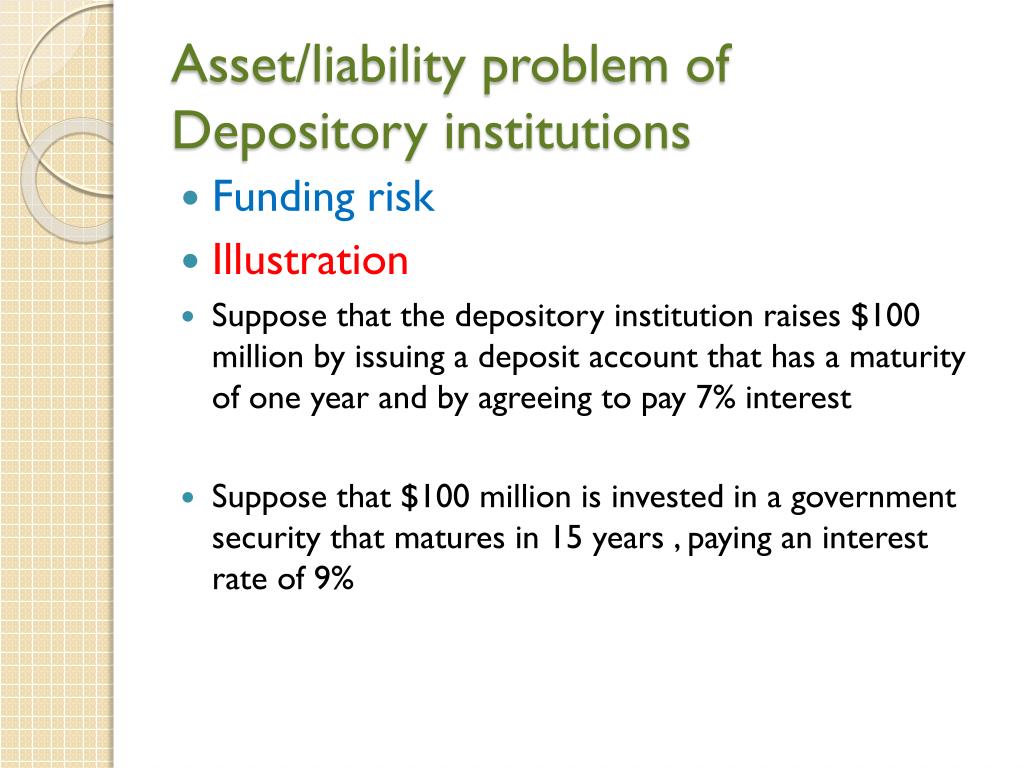

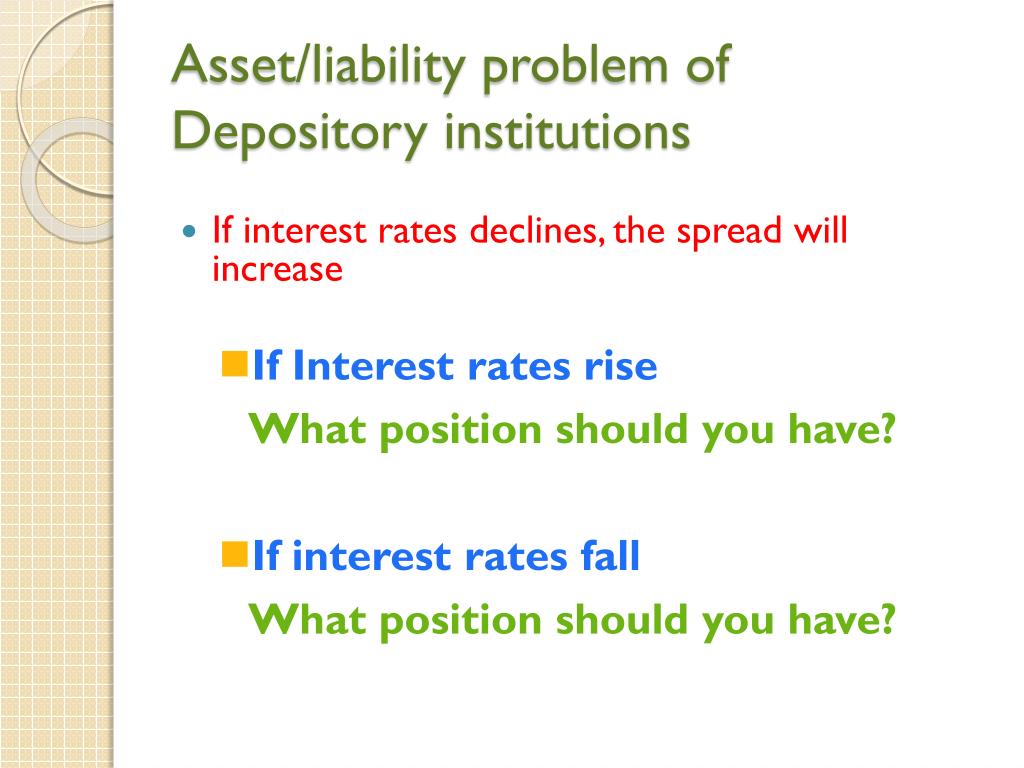

Security of your funds. 4 Similarly commercial banks would finance 5- and 7-year fixed-rate term loans with demand and savings deposits both of which could be withdrawn at. What are two ways depository institutions keep your money safe.

Depository institutions offer the ability to. A depository is a facility or institution such as a building office or warehouse where something is deposited for storage or safeguarding. The services offered by the large banks is the most diverse among all depository institutions.

Where your money is going If you have access to. What are 3 things you should consider when choosing a bank. A depository must return the deposit in the same condition upon request.

An outward or visible sign the institution of that sign by Christ and the giving of grace through the use of that sign are always necessary for the existence of a. What would be the three most important things I would look for in a depository institution. Security of your funds.

Depository institutions characteristically fund their longer-lived assets with shorter-term liabilities. Depository institutions all function in the same basic manner. What is the name of the depository institution you.

Depository Institution Research Checking Account Insurance multiple types TD Premier Checking must maintain an amount of 2500 in order to waive the 25 monthly fee unlimited check writing Insured up to 250000 with the FDIC per depositor Location Savings Account Multiple types. I would most importantly look at the fees charged interests rates offered and the insurance. Should you look for a low or.

Insurance and security such as safes and secure networks. For instance SLs historically funded 30-year fixed-rate mortgages with deposits that were often subject to withdrawal on demand. Credit unions are financial cooperatives implying that these depository institutions are owned by members of a particular group.

Anytime you give your money to someone with the expectation that the person will hold it for you and give it back when you request it youre either dealing with a depository institution or acting very foolishly. Limited purpose banking institutions such as trust companies credit card banks and industrial loan banks. Research Find a depository institution that offers at least one type of checking account and one type of savings account.

Works like a check but is faster and portable. What would be the three most important factors that you would consider when deciding which depository institution fits your needs. The top ten things you should consider when choosing a banking institution are.

The top ten things you should consider when choosing a banking institution are.

Depository Institution By Dylan Mentzer On Prezi Next

Ppt Depository Institutions Powerpoint Presentation Free Download Id 1658066

Depository Institution An Overview Sciencedirect Topics

Banking Procedures And Services Ppt Download

Depository Institutions Ppt Video Online Download

Depository Institutions Ppt Video Online Download

Depository Institution An Overview Sciencedirect Topics

Ppt Depository Institutions Powerpoint Presentation Free Download Id 1658066

Types Of Financial Institutions Depository Institutions And Non Depository Institutions

Depository Overview Functions Types Of Institutions

Ppt Depository Institutions Powerpoint Presentation Free Download Id 1658066

What Are The Differences Between Depository Institutions And Contractual Savings Institutions Quora

Financial Institutions Definition Example Top 2 Types

What Are The Functions Of Depository Institutions Lisbdnet Com

Depository Institutions Ppt Video Online Download

Financial Institutions Intelligent Economist

Depository Institutions Ppt Video Online Download

What Are The Functions Of Depository Institutions Lisbdnet Com

Comments

Post a Comment